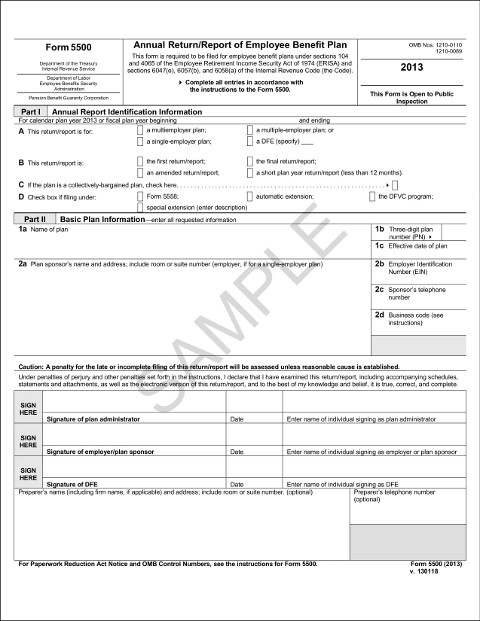

5500 Form Preparation

Don’t Do This or You’ll Fail A DOL Audit

Each year, thousands of employers go through the motions to prepare their annual health & welfare 5500 form.

Interestingly, it’s one of the most misunderstood and incorrectly handled compliance requirements – despite it having one of the largest set of fines and penalties for non-compliance.

Employee benefit plans that need to satisfy their annual reporting requirement under ERISA and the Internal Revenue Code use the 5500 form and associated schedules.

It’s filed electronically with the EBSA, an agency of the United States Department of Labor responsible for administering, regulating and enforcing the provisions of ERISA. It is used to report the plan’s financial condition and operations.

It’s this very fact – that it’s a requirement under ERISA and not a “tax return” that gets so many plans in trouble.

Whether the employer prepares the filing themselves or asks their broker or consultant for help, most never take into account how ERISA applies to the plan(s) which determine how the 5500 form should be prepared – and how many filings need to be prepared.

Learning how ERISA impacts your 5500 form preparation can save you thousands of dollars:

These FREE videos give you insights into big mistakes made on Form 5500’s. They cover:

Group Benefit Compliance Requirements by Employer Size

Does ERISA and it’s requirements apply to you?

What do you mean I’m missing a plan?

ComplianceBug is the leading provider of online compliance solutions for employers and professional advisors that makes group benefit and HR compliance easy, affordable and reliable.