ACA Compliance

Employer Strategies to Avoid Costly Plan Mistakes

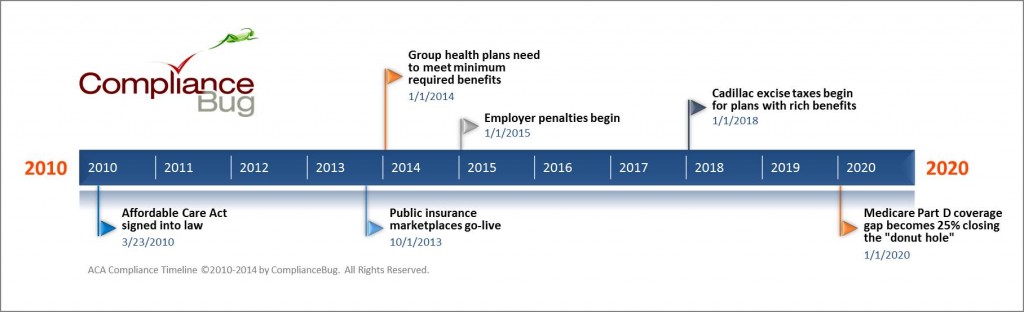

Healthcare reform added several additional layers to an already complex world of employee benefit compliance. The Affordable Care Act (ACA) requires employers to assume several responsibilities.

Businesses large and small need to determine exactly how to implement the requirements to meet ACA compliance. Failure to do so can lead to penalties of nearly $3,000 per employee.

It’s critical that employers take a pro-active approach to ensure they are on the right-track. Unless your plan was grandfathered, there are several ACA compliance requirements in effect since 2012. Many of requirements mandate the employer update their plan designs and administrative practices around other laws (like ERISA compliance and/or cafeteria plan compliance).

Additional requirements began in 2013 requiring applicable large employers meet minimum coverage standards. Additionally, employers have many other administrative record-keeping requirements to ensure are in place. These include government reporting and eligibility tracking.

The important take-away here is that an employers (both large *and small*) need to have a methodology to determine whether they meet all of the numerous ACA compliance requirements.

Get the practical advice you need to deal with the ACA compliance requirements:

These FREE videos give you a detailed roadmap to become ACA compliant. They cover:

Group Benefit Compliance Requirements by Employer Size

An Integrated Approach to Compliance: A Must Have

ComplianceBug is the leading provider of online compliance solutions for employers and professional advisors that makes group benefit and HR compliance easy, affordable and reliable.